The growth of markets is the single most significant socioeconomic development to occur in North Korea over the last 20 years. An understanding of this change is critical for the formulation of North Korea policy, but the underlying issues have been relatively understudied in comparison to North Korea’s nuclear weapons program and prospects for denuclearization.

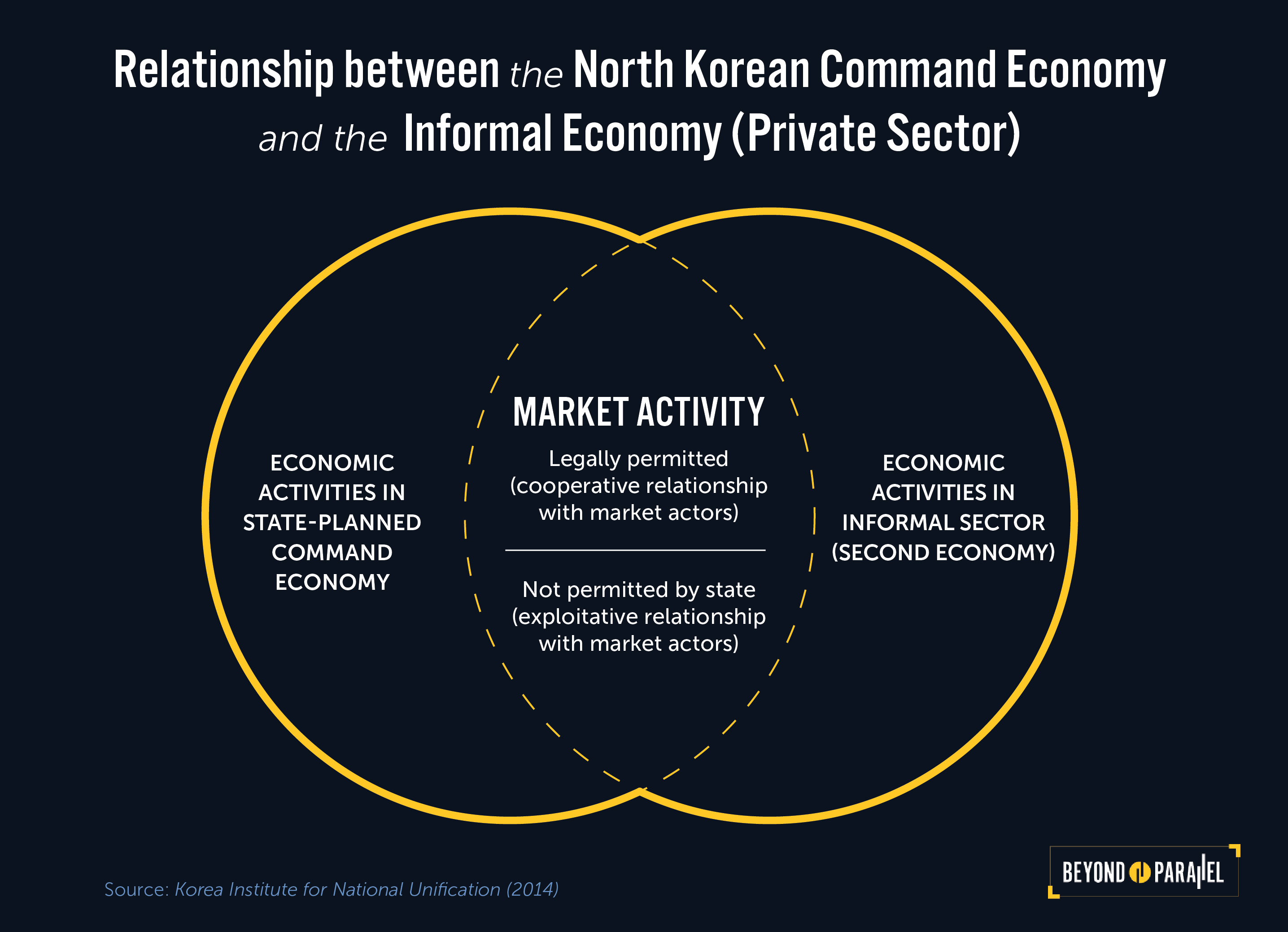

The North Korean economy is still theoretically run under a centrally-controlled and state-planned system. However, on-the-ground conditions show a reality that is quite different. Information from various sources, including internal in-country and external out-of-country data, demonstrates that the North Korean economy is increasingly penetrated by private market activity.1

In 2017 and 2018, Beyond Parallel launched a pioneering and original data collection project on markets in North Korea to study the changes happening in the country.2 The project’s objectives are: 1) to provide a comprehensive dataset on markets in North Korea; 2) to determine, based on this data and research, whether there is validity to the theory that a critical mass of markets could form the basis of a civil society in the otherwise highly repressive society; 3) to make the data accessible to policy experts and scholars through an interactive online format; and 4) to utilize the data to analyze current economic conditions as well as future strategic economic development plans for North Korea. The original interactive map below provides a broad overview of the data collected for this project.

Interactive: Each yellow dot on the map represents the geographical location of a market. Click on each dot to gain specific information about the market including its name, size (in square meters), and the estimated number of stalls it contains. Click the left mouse button on the map using the arrow or hand symbol to drag the map around to a different location. The zoom in/out function in the upper left-hand corner may be used to explore each region in more depth and view a close-up of the markets through satellite imagery at the ground level. The street map view and satellite image layer may be toggled on and off in the top left corner. Various layers of province and county data may be toggled on or off by selecting options on the main menu to the right.

This Beyond Parallel study captures the true size and omnipresence of markets in North Korea today. The markets mapped are officially sanctioned by the regime and are tacitly permitted to operate so long as vendors pay “taxes” or “rents” to the state. There are black markets that also operate outside of state control, but they have not been included in this dataset. This data includes: the geographical location of the general markets,3 their physical footprint, approximate number of vendor stalls,4 and the estimated rents generated for the regime through market activity. This information was collected and calculated through satellite imagery analysis and field interviews, and was further refined through cross-referencing with North Korean defector testimony and secondary source materials. Future posts on Beyond Parallel will explore various dimensions of this data in greater detail including regional analysis of the markets.

Key Findings

- A Beyond Parallel study of markets in North Korea found that there are at least 436 officially sanctioned markets located across the country.5 Markets are located in rural and urban areas and appear to be deeply integrated into both the economy and society. There is an average of 48 markets located in each of the nine provinces, including the special cities of Pyongyang, Nampo, and Rason. Less populated provinces such as Chagang and Ryanggang, however, have less markets than the average.

- The demands for “bottom up marketization”6 from the people, a development that began more than 20 years ago, contend with the government’s efforts to control, manipulate, and institutionalize the markets. When the government periodically represses market activity, society reacts angrily. But, the government also tacitly allows their growth to limit the negative socio-political and economic impact of the markets.

- The Beyond Parallel study found that the estimated revenue generated for the government through taxes and fees imposed on those markets is approximately $56.8 million dollars per year.7 This is against the backdrop of other studies that have found an estimated 2.8 million USD 8 to 69.5 million USD 9 earned per year by the government in market taxes or rents. The markets range in size from 256 square meters to 23,557 square meters. The largest market in North Korea (Sunam market, Chongjin) occupies an area of 23,557 square meters and generates an estimated $849,329 USD per year for the government.

- The sheer volume and geographic distribution of markets indicates that they have become an institutionalized part of North Korean society. The advent of mobile phone technology, SMS texting (within the state’s intranet and closed cellular system), and growth of private transportation networks suggests there is evidence that a latent civil society could be emerging around these markets as citizens share information, commerce, and further promote growing autonomy of livelihood through these markets.10

- Original Beyond Parallel microsurveys with North Korean residents currently living in provinces across North Korea also found that 100% of the North Korean respondents feel the government’s public distribution system does not provide them with what they want for a good life and 72% received almost all of their household income from markets. Furthermore, 83% of microsurvey respondents found outside goods and information to be of greater impact on their lives than decisions by the North Korean government.

Emerging from the Shadows: The Growth of North Korea’s Formal Markets

Experts disagree about the exact origins of the process of marketization in North Korea, but they agree that the collapse of external support from the Soviet Union and the famine of the 1990s was a significant driver for and accelerator of the process.

For decades under the centrally-planned North Korean economy, the regime used a public distribution system (PDS) to provide people with food and basic necessities across all regions. However, after a devastating country-wide famine in the 1990s and the dissolution of external support from the Soviet Union, the PDS system collapsed and the North Korean people turned to trading and bartering goods in informal black markets to survive.

Informal markets gave way to regularized, state-sponsored markets over time. Since 2002 and 2003, the regime has tacitly allowed the operation of some markets with formal and informal taxation of vendors. Thriving trade on the border between North Korea and China also supported the growth of these markets, particularly in earlier years when smuggling was highly profitable for goods that were hard to produce or acquire inside the country. The process of marketization over the last 20 years has been full of fits and starts and is arguably far from complete. There have been periods when the process was driven by “bottom-up marketization” and market activity adopted by the North Korean populace for the purposes of human survival.

There have been other times when space for private economic activity expanded because the regime loosened regulatory controls to relieve pressure caused by severe social, political, and economic mismanagement. The government has also from time to time cracked down on the markets using the state security and police apparatus to repress market activity or enforce policies designed to stifle their growth.11

A 2016 microsurvey conducted by Beyond Parallel of North Koreans in the country suggests through anecdotal evidence that the general public reacts negatively to any attempts by the government to suppress the market. In response to a survey question about what caused them to feel the greatest animosity toward the government, many respondents said currency redenomination (화폐 개혁), or attempts by the regime to destroy the private cash holdings of regular citizens, made them feel angry. For example, in answer to this question one North Korean replied he felt resentment “when the Ministry of People’s Safety/Security took the seed money I had saved to do business (장사 밑천을 보안서에 빼앗겼을 때)” and another respondent asserted he was upset by the “seizure of assets (재산 몰수).” Similar findings have come from reports that are based on the testimony of North Korean defectors.12

Markets have improved the quality of life of North Korean people and are now an important stabilizing force for determining the cost of food and goods inside the country. Beyond Parallel’s microsurvey project in provinces across North Korea found that 72% of respondents received almost all of their household income from markets. Additionally, 83% of microsurvey respondents found outside goods and information to be of greater impact on their lives than decisions by the North Korean government. Given such significance of market trade and bartering activities, it is not surprising that anger over government predation of market activities and individuals’ entrepreneurial efforts to better their lives was prevalent.13

When one combines these attitudes and the ubiquitous growth of cell phone connectivity (on an internal network) and the growth of private transportation networks inside of the country, it may be possible to eventually imagine the growth of a nascent civil society.14

Civil society formation in North Korea, as defined by Professor Andrew Yeo in his study of defectors’ accounts, is characterized on the ‘demand’ side by “motives, incentives, and opportunities for ordinary North Koreans to organize apart from the state, whether through informal markets or through some other avenue of association. The ‘supply’ side includes the extent to which the flow of outside information or regular interactions with foreigners through humanitarian, development, and other people-to-people exchanges might encourage a nascent civil society in closed regimes such as North Korea. In particular, if market exchanges help build social networks outside of government control, or if interaction with foreign actors and other North Koreans at the local level helps foster social capital, one might be able to point to the early trappings of civil society in North Korea.”15 Though still in nascent stages, the markets, cell phone connectivity, and evidentiary changes in attitudes separating the citizens’ livelihood from government provisions could suggest the growth of a civil society in North Korea revolving around these ubiquitous markets.16

While there is disagreement in the literature over how advanced North Korea’s marketization appears to be, it is clear markets have significantly impacted social, political, and economic conditions inside the country. 17

Beyond Parallel’s study “A View Inside North Korea,” is one of the first to examine and get information directly from North Koreans about how the growth of markets affects their thinking. Most of the qualitative studies that attempt to explore these issues are only available in the Korean language and draw primarily from the testimony of North Korean defectors and traders in the China-North Korea border region. This Beyond Parallel study is one of the first to use geographical data on markets to produce policy-relevant findings for decisionmakers. These research questions and additional dimensions of market data will be explored in greater depth in subsequent posts. Through this innovative work, Beyond Parallel has shed new light on the complexity of North Korean peoples’ growing dependence on markets and the process of institutionalizing market activity.

Types of Markets

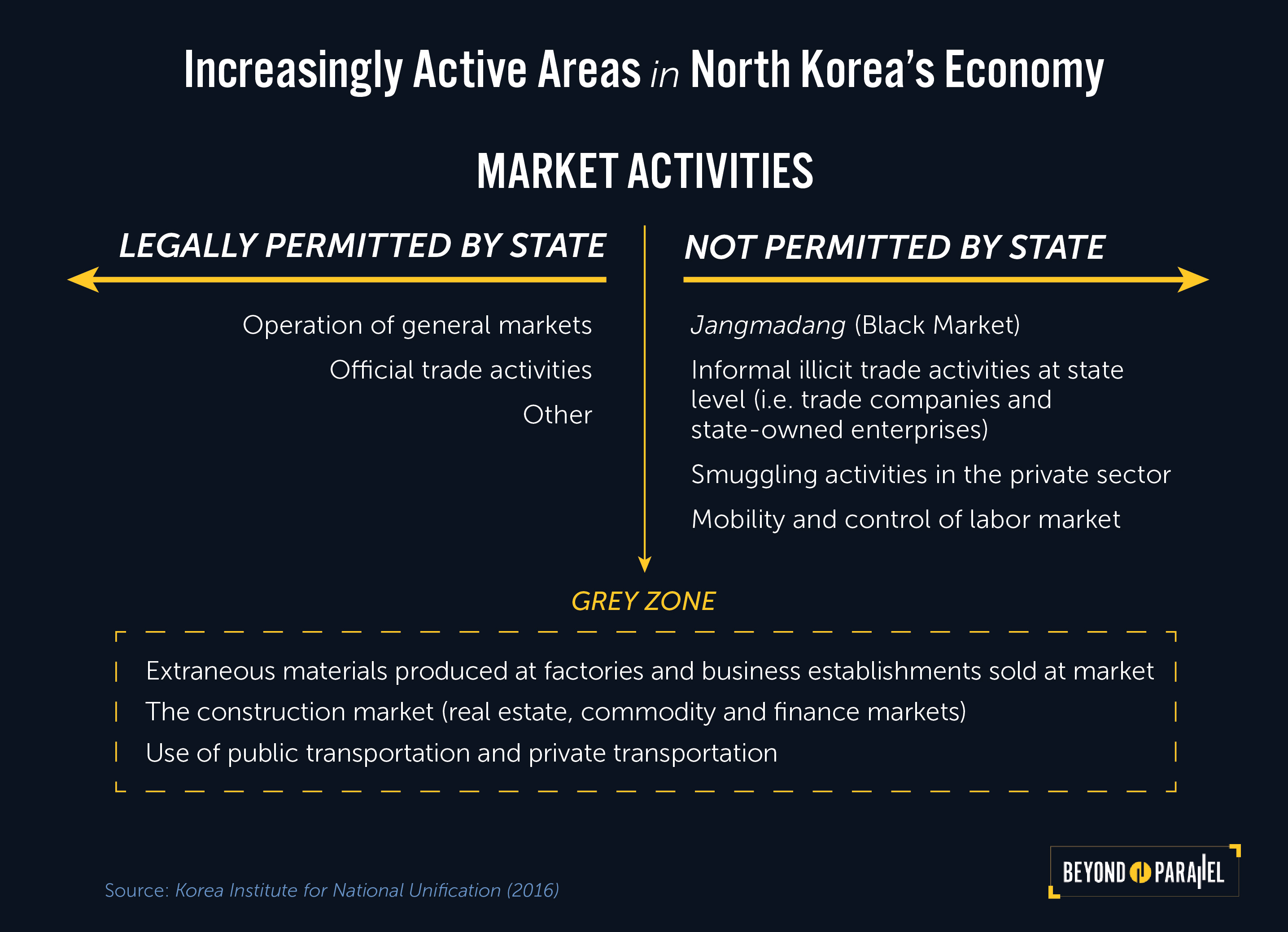

This study revealed a distinction between official general markets and unofficial black markets in North Korea. Official markets are authorized by the government through operating licenses, while unofficial markets are those without an official governmental license. Vendors in official markets must pay rent to government organizations daily to sell goods or services.18

Unofficial markets are usually set up in residential areas, without fixed, permanent boundaries and vendors do not pay official “taxes” or “rents.” They may, however, be susceptible to regular shake-downs by the security forces or police who may demand bribes to allow their continuing operation. Regularly operated state-sponsored markets are identifiable through satellite imagery because they are housed in permanent buildings, while unofficial markets are difficult to locate because of their use of makeshift structures and spaces.

Markets are also classified based on their method of operation: some markets open every day, while others are open temporarily only once every 10 days. There is also a distinction between wholesale markets and retail markets, depending on the volume and the type of goods sold. Finally, markets are classified based on their physical structure—they can be permanently housed in buildings, appear as open-air outdoor markets with some roof covering, or consist of temporary, yard-sale type markets set up in empty fields or urban spaces.19

Rules and Regulations on Market Establishment

In July 2002, the North Korean government implemented new reforms to save the economy from further recession, officially allowing state-sanctioned markets to operate. On May 20, 2003, the government released a document outlining the regulations for establishing and operating markets. The document was internally distributed to province, county, city, and village-level institutions.20

After this measure was implemented, each province, county, city, and village began to create new markets based on the municipality’s unique traits and production capacity, and to expand the size of markets. The North Korean government set specific market-construction standards and requested that all markets be rebuilt accordingly. It appeared that this first phase of market expansion was completed by the late 2000s. The first building-type market was established in Tongil Street, Pyongyang. Six months after the establishment of Tongil Street Market, the government ordered more markets of this type to be created. As a result, markets nationwide were uniformly constructed into building-type markets, first in Pyongyang, Hamhung, and Chongjin and then all over the country.21 These structures can be identified in satellite imagery.

After the rapid growth of markets, limited regulations were implemented between 2003 and 2007 in order to alleviate the side-effects of marketization. Measures were taken to reduce inflation, correct imbalances in the supply and demand of goods, and to eliminate possible sources for disruption to society. The North Korean government also enacted a currency reform in late 2009, which ultimately failed. Since 2009, the government has not attempted the same type of currency redenomination action but has used state security and police apparatus to crack down on market activities and market actors.

The protocols regarding general markets enacted in 2002 are listed below:22

-

- 1. Departments of commerce and the People’s Committees in each province, county, and district or neighborhood responsible for the respective commercial industries shall establish one or more markets in an easily-accessible location, in accordance with each region’s population size and unique regional characteristics, to be used by the municipal or town residences.

-

- The size of each market should depend on the population:

-

- – 600 stalls in a city or town of a population of 30,000-40,000

-

- – 900 stalls in a city or town of a population of 40,000-50,000

-

- – 1,200 stalls in a city or town of a population of 50,000-70,000

-

- – 2,000 stalls in a city or town of which the population size exceeds 70,000

- 2. Departments of commerce and the People’s Committees in each province, county, and district or neighborhood and the respective commercial industries shall title the markets according to the name of the specific municipality.

- 3. Departments of commerce and the People’s Committees in each province, county, and district or neighborhood shall continue to modernize each market with renovations and/or expansions.

- 4. When building new markets, departments of commerce and the People’s Committees in each province, county, and district or neighborhood shall consider local city planning designs, follow market design standards, and plan according to the finances of each town or city.

Methodology

To collect information on the markets this project used three different methods of research. First, CSIS worked with data on the markets initially provided by the North Korea Development Institute.23 To gather this data, extensive interviews of recent defectors from relevant regions of North Korea were conducted in South Korea. Geospatial data analysis of Google satellite imagery was also conducted to gather additional information on markets such as their location and size. Second, a review of literature was carried out and the data was also translated into English. Third, geospatial data was cross-referenced with reports and secondary resources to verify its accuracy.

For initial field research conducted by NKDI, a pool of potential interview candidates was selected based on relevant research criteria. Through a screening and pre-interview process, a research team carefully narrowed down the pool of interviewees to those with relevant, first-hand experience. To further ensure that the information provided by North Korean defectors was accurate, focused, in-depth interviews were conducted with the help of other North Koreans from the relevant region or district.

References

- See Byung-Yeon Kim, Unveiling the North Korean Economy: Collapse and Transition (Cambridge, UK: Cambridge University Press, 2017); and Hazel Smith, North Korea: Markets and Military Rule (Cambridge, UK: Cambridge University Press, 2015); In-country information about North Korea’s economy comes primarily from the staff of humanitarian aid organizations and foreign embassies allowed to reside for short periods of time in the DPRK. Additional information comes from interviews with recent defectors from North Korea; For full bibliography of references consulted for this report click here. ↩

- CSIS partnered with the North Korea Development Institute in Seoul on this project. NKDI is a non-profit organization in South Korea dedicated to research on North Korean development. NKDI conducts research using satellite imagery analysis and geospatial data. The researchers use their experience having been born in or having lived in North Korea to bring added value to their work. The mission of the institute is to accumulate geospatial data and information for the development of public welfare infrastructure and formulation of future strategic economic development plans for North Korea. The organization also seeks to promote cooperation between North Korean defectors, South Korean researchers, and experts from across the region. ↩

- General markets are those that have been permitted to operate legally by the government. Vendors are charged a fee to obtain a license (Waku – 와쿠) that allows them to sell goods and services at the general market. They must also pay daily rent or taxes to operate physical space or stalls (매대) where the goods and services can be sold at market. These rents can range from 500 Korean People’s Won (KPW) to 2,500 KPW per day. The names of the markets included in this dataset are those that have been designated by the North Korean government. In some cases, the markets may also be called by another colloquial name by residents in the region. The estimates for North Korean population data in the map are from the following report: Korea Statistics Promotion Institute (한국통계진흥원), 2017 Major Statistics Indicators of North Korea (2017 북한의 주요통계지표), Statistics Korea (통계청), 2017. The data is based on the 2008 North Korean census as that is the only reliable in-country data source available. ↩

- The concept of vendor stalls (매대) may be smaller and different in structure in North Korea than the Western concept. Vendors occupy a space ranging from 1.4 square meters to 1.9 square meters which may be the equivalent of a small booth or table in the Western world. The term may also be used to describe an ad-hoc tent or open air space where vendors spread out and sell their goods on an available surface. ↩

- Satellite imagery data is currently available for 418 of the 436 markets. The numbers of markets are from analysis of Google Earth imagery and are accurate as of early 2018. Other experts have estimated that there may be upwards of 480 markets in North Korea, see work of Curtis Melvin at http://www.nkeconwatch.com/2018/02/05/north-korean-market-update/. DailyNK has estimated there are 387 markets and the Korean Institute for National Unification has estimated there are 404 markets throughout the country. ↩

- Stephan Haggard and Marcus Noland, Famine in North Korea: Markets, Aid, and Reform (New York: Columbia University Press, 2007). This process also called “marketization from below” or “defacto marketization” is described in detail in Haggard and Noland’s work; See also Hazel Smith, North Korea: Markets and Military Rule, p. 211-234; and Byung-Yeon Kim, Unveiling the North Korean Economy: Collapse and Transition (2017); There is a debate in the literature about the state of marketization in North Korea and the potential social and political impact of the process. Some experts have argued that the socio-political impact is deep and widespread while others have claimed the changes are more limited. Experts have used different terms from “market socialism” or “decentralized socialism” to “marketization without liberalization” and “segmented marketization” to describe this process and its economic and socio-political impact on the country. See also Philo Kim, “The Segmented Marketization of North Korea and Its Sociopolitical Implications,” Asian Perspective 42 (2018): 1-31; ↩

- The figure was calculated by totaling the tax revenue (“rents”) collected by the government in each individual market. The process of calculating the yearly rents in each individual market included the following: 1) Measured the total area (m2) for each market in satellite imagery/Google Earth; 2) Estimated the number of stalls in each market by dividing the total building area by the approximate area for a small vendor stall (range from 1.4 m2 to 1.9 m2 depending on county and city); 3) Multiplied the estimated number of stalls in each market by an average tax/rent (1,425 KPW per day) charged by government to vendors for daily market operation; 4) Multiplied the daily tax calculation by 294 days to get a yearly tax estimate – this number accounts for market closing on North Korean holidays and Sundays (365 days minus 52 Sundays and 19 holidays); 5) After calculating the yearly tax total for each market, the revenue amount was converted to USD by dividing the total by 8,300 Korean People’s Won. This is the market exchange rate that comes from the DailyNK market trends data and a 2016 KINU report (North Korea National Market Information: Focus on Status of Formal Markets). The official exchange rate is approximately $1 USD/130 KPW (versus $1/8300 KPW) but those numbers appeared to be too inflated so the market exchange rate was used as the primary calculation; 6) The yearly USD revenue for each market was totaled to get the figure $56.8 million (estimated). ↩

- This estimate comes from a report published by DailyNK based on an examination of 387 markets across the country. See In Ho Park, et al., The Creation of the North Korean Market System, p. 24. ↩

- This estimate comes from a report published by KINU which investigated 404 markets across the country and estimated the rents generated from them. See Min Hong (홍민), et al., North Korea National Market Information: Focus on Status of Formal Markets(북한 전국 시장 정보: 공식시장 현황을 중심으로), p. 54. The numbers contained in the Beyond Parallel map are based roughly on the same estimation formula as KINU. ↩

- See Yonho Kim, North Korea’s Mobile Telecommunications and Private Transport Services in Kim Jong Un Era, Washington D.C.: US-Korea Institute at SAIS, 2018; See also Nat Kretchun, Catherine Lee, and Seamus Tuohy, Compromising Connectivity: Information Dynamics between the State and Society in a Digitizing North Korea (Washington D.C.: InterMedia, 2018); See also Justin V. Hastings, A Most Enterprising Country: North Korea in the Global Economy (Cornell University Press, 2016), p. 110-117. ↩

- The regime has sought to institutionalize some aspects of the markets and has created an elaborate system of organization. The process of institutionalization has been slow and fitful as the government realized that the markets were a necessary stop-gap measure to counterbalance the failures and gaps in the state-planned economy. The organizations used to manage, control, and sometimes repress the markets will be explored in a future Beyond Parallel post. ↩

- North Korean Public Perception on Unification 2015 (북한주민 통일의식 2015), Institute for Peace and Unification Studies, Seoul National University, 2015. Same report also published in 2016 and 2017 here. ↩

- The organizations used to manage, control, and sometimes repress the markets will be explored in a future Beyond Parallel post. ↩

- North Korean people are not allowed freedom of movement as we understand it in a democratic society. Ordinary North Korean citizens must obtain a permit to leave their city or village of residence and travel to a different area. This is like the equivalent of having to apply for government permission (such as a passport and visa) to travel from New York City to Washington, DC. However, there are increasing numbers of cars, trucks, and buses that are used illegally to transport citizens from one area of the country to another. As cellphone usage in the country rises, we also often hear stories of citizens texting each other about the price of commodities in the different markets; See Yonho Kim, North Korea’s Mobile Telecommunications and Private Transport Services in Kim Jong Un Era (2018). ↩

- Andrew Yeo, “The Prospects of Civil Society and Domestic Change in North Korea,” presented July 23, 2018, https://www.ipsa.org/events/congress/wc2018/paper/prospects-civil-society-and-domestic-change-north-korea. ↩

- There are other studies that argue that the socio-political impact of the markets is more limited because of government control. At least one other scholar has argued that the regime’s creation and implementation of a system of regional self-reliance (자력 갱생) has “fundamentally constrained the spread of markets and marketization.” See Philo Kim, “The Segmented Marketization of North Korea,” p. 3. ↩

- A growing body of academic work further explores this process of marketization and the potential impact on the economy and North Korean society. See Dae Seok Choi and In Sook Jang (최대석, 장인숙), North Korea’s Marketization and Fissure in the Political Society (북한의 시장화와 정치사회 균열), Seoul, Korea: Sunin (선인), 2015; Eun Lee Jeong (정은이), A Study on the Development of the North Korean Market: The Regime’s Process of Pressuring the Public through Control and Tolerance (북한 시장의 발전과정에 대한 연구: 통제와 이완을 통한 인민의 압력에 대한 당국의 추인과정을 중심으로), Export-Import Bank of Korea (한국수출입은행), 2014; Korea Institute for National Unification (KINU) (통일연구원), Relationship between North Korea’s Marketization and Human Rights (북한의 시장화와 인권의 상관성), North Korea Human Rights Policy Research (북한인권정책연구), Korea Institute for National Unification (KINU) (통일연구원), 2014; Moon Soo Yang (양문수), The Marketization in North Korean Economy (북한경제의 시장화: 양태·성격·메커니즘·함의), Hanul Academy (한울 아카데미), 2010; Moon Soo Yang (양문수), The Economy and Society in Kim Jong-Un Era: New Relationship between the State and Market (김정은시대의 경제와 사회: 국가와 시장의 새로운 관계), Research Series (연구총서), The Korean Association of North Korean Studies (북한연구학회), Hanul Academy (한울 아카데미), 2014; Moon Soo Yang (양문수), Understanding North Korea’s Market and Market Economy Through Statistical Analysis (통계를 통한 북한경제의 이해와 북한의 시장경제), University of North Korean Studies (북한대학원대학교), 2014; Min Hong (홍민), “Regional Dispersion and Operation Status of North Korea’s General Markets (북한 종합시장의 지역별 분포와 운영 현황),” Trends and Analysis (동향과 분석), Korea Development Institute, 2017; For additional background, see also Nicholas Eberstadt, The North Koreans Economy: Between Crisis and Catastrophe (New Brunswick, NJ: Transaction Publishers, 2009. ↩

- Information from this section is from a report by the North Korean Development Institute. Report on file with the authors. ↩

- Report by North Korean Development Institute on file with the authors; See also Benjamin K. Silberstein, Growth and Geography of Markets in North Korea: New Evidence from Satellite Imagery, Washington D.C.: US-Korea Institute at SAIS, 2015; and work by Curtis Melvin at 38North, http://38northdigitalatlas.org and North Korean Economy Watch, http://www.nkeconwatch.com/. ↩

- Information from this section is from a report by the North Korean Development Institute. Report on file with the authors. ↩

- Ibid. ↩

- Pyongyang, “Korea’s Commercial Order of the Democratic People’s Republic of Korea,” No. 48, May 20, 2003. 평양, “조선민주주의 인민공화국 상업성지시,” 제48호, 2003년 5월 20일. ↩

- See reference number 2 above. ↩